组合式MEMS惯性传感器今年汽车市场增长率将达到77%

由于汽车安全系统正在快速地加速采用组合式MEMS惯性传感器,其营收今年将继续保持直线上升态势,预计今年它将成为汽车市场的一个新增长亮点。

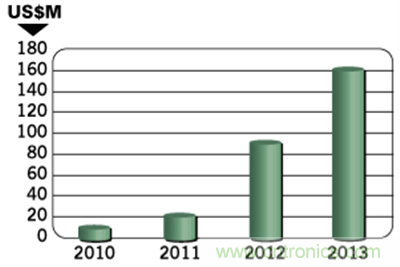

全球汽车市场用组合式MEMS惯性传感器的营收预计今年将从去年的9千万美元快速上升到1亿6千万美元,增长率将达到引人侧目的77%。去年的增长率更是惊人,达到338%,因为2011年的营收只有1千万美元。

组合式MEMS惯性传感器今年汽车市场趋势

组合式MEMS惯性传感器在一个封装内集成了加速度计和陀螺仪,为汽车的电子稳定控制系统(EPS)提供惯性输入,防止或最小程度地防止紧急刹车。

“EPS系统的安装在北美、欧洲、以及法令越来越成熟的地区如澳大利亚、日本、加拿大和韩国是强制执行的,”MEMS和传感器资深分析师Richard Dixon博士说,“但发展中国家如中国存在着巨大的增长机会,考虑到中国市场的巨大规模,中国对EPS系统的全球渗透率有重大影响。而这反过来为汽车组合式MEMS惯性传感器提供了巨大的增长原动力和势头。”

为什么组合式传感器有这么大增长?

目前汽车EPS系统有三种架构:作为一个单独的EPS引擎控制单元(ECU)存在于一块PCB上;附在汽车刹车调制器上以节省走线;或存在于气囊ECU中。在这三种可用的位置里,目前的趋势倾向于在气囊ECU中安装EPS系统,以实现更小的占板面板和更高的效率,因为这一位置上的ECU有空间限制,因此它倾向于尺寸更小的架构。

我们被告知,如果使用像Continental的组合式传感器EPS系统,与采用分立式传感器搭建出来的相同EPS系统,组合式MEMS惯性传感器可以将空间需求降低五倍。

A non-combo solution also exists in the form of the sensors separately mounted on the PCB. But deploying the sensors in a combo form factor saves not only on packaging cost but also on expensive real estate for the semiconductors being used, since the two sensors in the combo package share the same application-specific integrated circuit.

成本是一个重要因素

A paramount issue for ESC systems is cost. Cost is especially important because ESC formerly was considered an optional feature—but since being mandated by governments—it now has attained the same required status as the seat belt.

As a result, the entire supply chain and price structure forautomotive combo sensorshas been experiencing huge pressure, exerted from car makers down the chain. Tier 1 companies then pass on this pressure to their suppliers, accounting for the accelerated move to provide efficient combo sensor solutions for inertial sensors in the system.

Because of such pressure, some top-tier companies have indicated that only legacy businesses will use older arrangements featuring separate sensors—not a combo solution—on a printed circuit board in the future. All new car models will use combo sensors.

博世和村田是2家主要供应商

The major suppliers of automotive combo inertial sensors are Bosch of Germany and Japan’s Murata (formerly VTI). Two other potential manufacturers, Panasonic of Japan and Massachusetts-based Analog Devices, will need to develop similar solutions to have a chance in the market.

For its part, Panasonic has indicated that a product will be available by 2014. Panasonic Industrial makes the gyroscope part of the solution, while Panasonic Electric Works makes the accelerometer component.

However, the two entities do not have a good track record of working together, so it remains to be seen how soon a unified combo sensor solution from Panasonic will come to market.

Meanwhile, Analog Devices is divulging little information, but it will almost certainly develop a combo sensor solution, IHS iSuppli believes, based on an analysis of developments surrounding the competition.